The Government of India has launched a special loan scheme to support street vendors, small shopkeepers, and people running roadside businesses. This scheme is officially called the PM SVANidhi Yojana (Pradhan Mantri Street Vendor’s Atmanirbhar Nidhi). The primary aim of this scheme is to help small vendors recover their business, especially those affected by the pandemic and financial challenges.

For this scheme, the central government has allocated ₹5,000 crore. The amount is meant to provide financial relief to lakhs of small traders who often struggle with moneylenders charging very high interest rates. Through this initiative, the government is not only providing loans but also empowering small business owners to become financially independent.

Loan Amount and Interest Rate

Under the PM SVANidhi Yojana, eligible applicants can receive a loan of up to ₹10,000. This loan helps street vendors and small shop owners restart or expand their business. The special feature of this loan is that it is an unsecured loan, which means no collateral or security is required.

The interest rate is charged at a normal market rate, much lower than what local moneylenders demand. Moreover, if the borrower repays the loan on time, they also get certain benefits such as interest subsidies and improved chances of receiving a higher loan amount in the next phase. This makes the scheme extremely useful for people looking to stabilize and grow their small-scale business without falling into debt traps.

Who Can Apply for PM SVANidhi Loan?

The loan is specifically designed for street vendors and small business operators. People running stalls, roadside carts, and handcarts are eligible. The following groups can apply under this scheme:

- Fruit and vegetable vendors

- Laundry shop owners

- Small salon and barbershop owners

- Pan shops and tea stalls

- Small food cart operators

- Any other small roadside retail business

The government estimates that around 50 lakh street vendors will directly benefit from this initiative. This will not only help them financially but also protect them from the burden of paying extremely high interest to private moneylenders.

Benefits of the Scheme

The PM SVANidhi Yojana provides multiple benefits to vendors:

- Easy and Quick Loan – No need for heavy paperwork or collateral.

- Affordable Interest Rate – Much lower than private lenders.

- Financial Independence – Helps vendors run their businesses without exploitation.

- Future Opportunities – On-time repayment increases eligibility for higher loans.

- Digital Benefits – Vendors who repay digitally get extra rewards and subsidies.

This combination of financial support and government backing ensures that small traders can sustain their livelihoods with dignity.

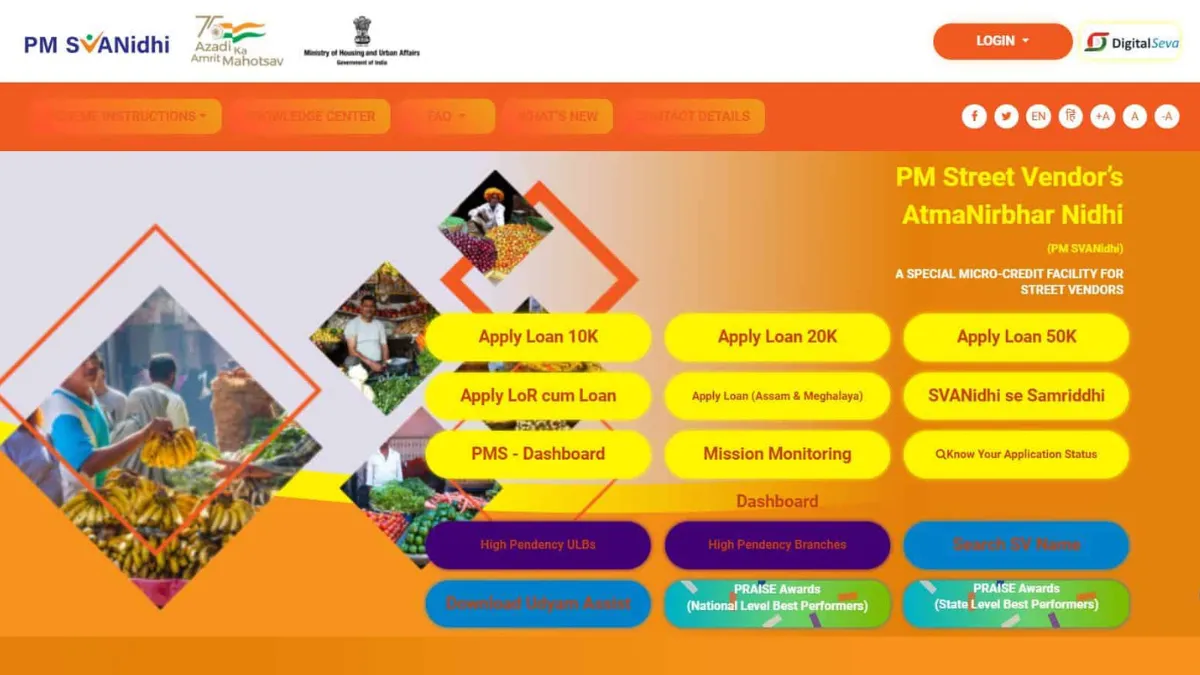

How to Apply: Step-by-Step Guide

If you are wondering how to get PM SVANidhi loan, here is a complete step-by-step guide:

- Visit the Official Website – Go to the official portal of the scheme: http://pmsvanidhi.mohua.gov.in

- Find Application Section – On the homepage, you will see the option Planning to Apply for Loan. Click on More.

- Read Terms and Conditions – A new page will open with detailed terms and eligibility rules.

- Download the Application Form – Click on View/Download Form. The application will appear in PDF format.

- Fill in the Details – Complete the form carefully with personal and business details.

- Attach Required Documents – Attach ID proof, address proof, and any business-related documents.

- Submit the Application – Submit the completed form with documents to the authorized institute, such as your local bank or lending institution participating in the scheme.

Once your application is processed and verified, the loan amount will be credited to your account. The process is designed to be quick and hassle-free, ensuring that street vendors can access funds without unnecessary delays.

Why This Scheme Matters

For decades, small vendors in India have been trapped by private moneylenders who charge interest rates as high as 20% to 30%. Many vendors are forced to pay more interest than the actual amount borrowed, which keeps them in a cycle of debt.

With the PM SVANidhi Yojana, the government is directly addressing this issue by providing affordable loans with transparent rules. It not only supports street vendors financially but also gives them an opportunity to build their credit history with formal banks. In the long run, this could open doors for higher loans, insurance, and other financial products.

Also read: PM SVANidhi Yojana: Street Vendors Can Get ₹90,000 Loan Without Guarantee, Extended Till 2030

Conclusion

The PM SVANidhi Yojana is a lifeline for millions of street vendors and small traders across India. By providing easy loans of up to ₹10,000 without collateral, the scheme is helping small businesses survive and grow in challenging times.

If you are a small shop owner, food cart operator, or street vendor and you want to know how to get PM SVANidhi loan, the process is simple: visit the official portal, fill the form, attach necessary documents, and submit it through an authorized institution.

This scheme not only provides financial support but also protects vendors from falling prey to moneylenders. With timely repayment and proper use of the funds, small traders can expand their businesses, increase their income, and secure a better future.